Every year, sometime around the first of the year, I get questions in my office about Calendar Year vs. Plan Year Deductible.

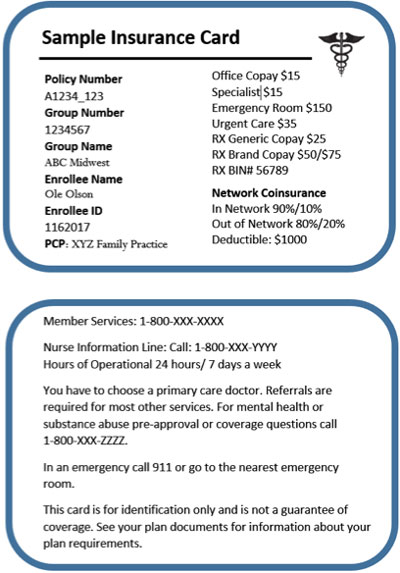

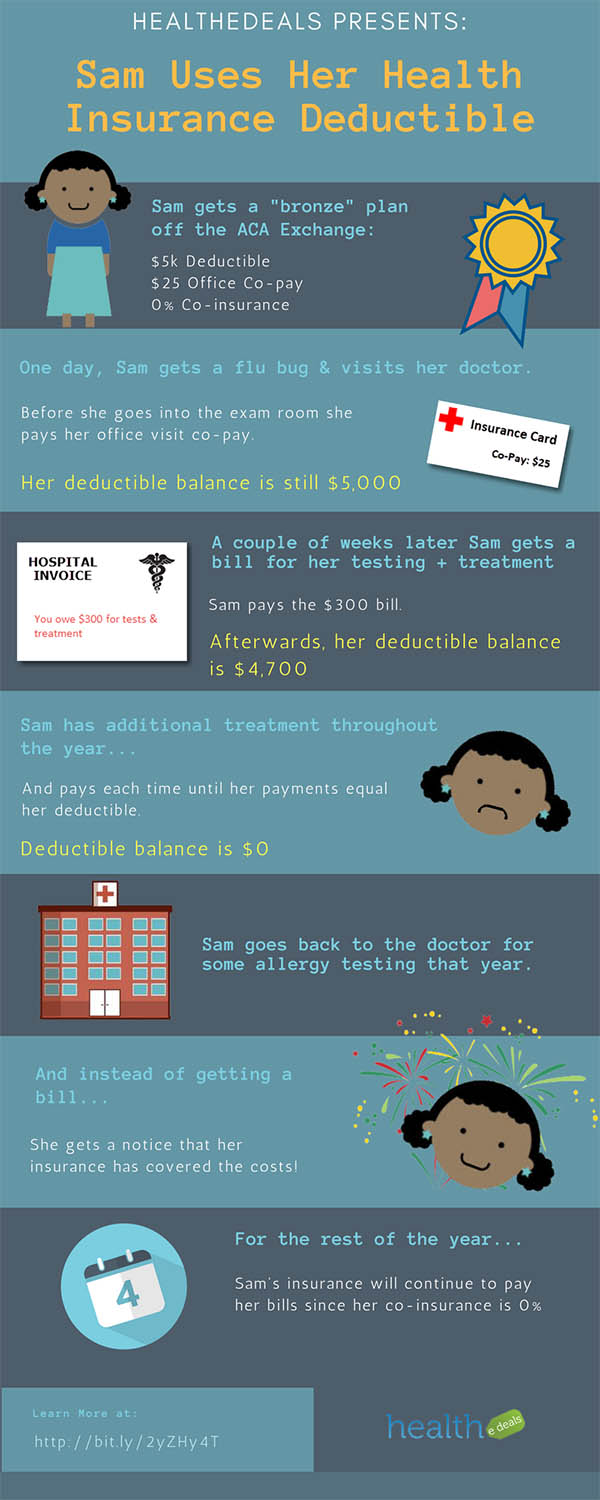

When we explain the benefits of a health insurance plan to our clients, we usually go through the deductibles and out of pocket maximums. The deductible is the amount you pay before the insurance company starts helping with the cost of medical services. You are responsible for paying the deductible.

If you qualify, the deduction for self-employed health insurance premiums is a valuable tax break. With the rising cost of health insurance, a tax deduction can help you pay at least a portion of the premium cost. And that will help to keep you healthy—and happy—in 2020 and beyond. The amount you pay for covered health care services before your insurance plan starts to pay. With a $2,000 deductible, for example, you pay the first $2,000 of covered services yourself. After you pay your deductible, you usually pay only a copayment or coinsurance for covered services. Your insurance company pays the rest. Your deductible is a fixed amount you have to pay each year toward the cost of your healthcare bills before your health insurance coverage kicks in fully and begins to pay (if you're enrolled in Medicare, the Part A deductible is based on benefit periods rather than the.

You have family health insurance coverage in 2020. The annual deductible for the family plan is $3,500. This plan also has an individual deductible of $1,500 for each family member. The plan doesn’t qualify as an HDHP because the deductible for an individual family member is less than the minimum annual deductible ($2,800) for family coverage. Health insurance costs are included among expenses that are eligible for the medical expense deduction. You must itemize to claim this deduction, and it’s limited to the total amount of your overall costs that exceed 7.5% of your adjusted gross income (AGI) in tax year 2020, the return you'll file in 2021.

After paying the deductible once per year, you don’t need to pay it again for the rest of the year. We call this meeting the deductible. This works great when you have the same plan, year after year, but this is no longer the norm for most people. Most people switch plans, have Qualified Life Eventsand things change.

Individuals – Calendar Year vs. Plan Year Deductible

What Is Yearly Deductible For Health Insurance

All individual plans now have the calendar year match the plan year, meaning no matter when you buy the plan, it will renew on January 1st. Even if you buy it on December 1st you will have a new deductible and plan on January 1, so it’s a good idea to try to avoid having medical expenses in that initial plan year if you can avoid it.

Small Businesses – Calendar Year Deductible may be the same as Plan Year Deductible

For health insurance Nevada plans, most of the businesses we work with do NOT renew on January 1. It’s been the standard for insurance companies to carry your deductible forward on to a new plan as long as you don’t change insurance companies or move to an individual plan.

What Does Yearly Deductible Mean For Health Insurance

Example: I have a small business health insurance plan that renews on June 1st. Early in the year, I met my deductible. I’m renewing with the same insurance company and the same deductible. In that case, the amount I’ve paid towards my old deductible, between January and June 1st, will count towards my new deductible, June through December. That amount resets at the end of December since it’s on a calendar year.

The same thing applies to an out of pocket maximum. If you have met your out of pocket maximum, it will NOT reset when the plan renews. It will, however, reset on January 1st or if you switch insurance companies or move to an individual plan.

Average Yearly Deductible For Health Insurance

I hope this cleared some things up about your deductible. Please remember that these rules are set by the insurance company, and companies are free to change the rules at any time. Please contact me with any specific questions you have about Plan Year Deductible vs. Calendar Year Deductibles. Our office number is (775) 828-1216. As your health insurance broker, we can help answer any questions and issues you have with your insurance policy.